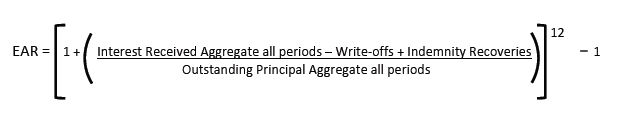

Formula Rules

The following are rules and examples when calculating the EAR:

Determining when loans can be included in the formula

To be included in the EAR calculation, a loan must have been issued more than three (3) months prior to the calculation date.

Determining which periods are included in the formula

If it’s been more than 3 months since loan purchase, an EAR can be calculated and displayed on an Investor’s summary page. After that, the EAR calculation is perpetual (until termination of the loan): meaning, loans don’t drop out after 12 months of history. This is why the formula is annualised and results in a fair assessment of determining an investor’s loan performance.

Limitations of EAR

EAR is just one method to calculate the return on cash invested in the Clearmatch P2P Lending Trust. We think it is the most useful and accurate way to measure investment performance and compare effective returns because it takes into account actual cash received and write-offs. However, there are other methods for evaluating historical investment returns on fixed-income securities that you could consider.