What is EAR?

The Effective Annualised Return (EAR) calculation is also known as effective annual interest rate method and is used as a consistent measure of comparing different interest rates. EAR includes the effects of intra-year compounding and is the annualised return on a loan restated from its nominal interest rate. It assumes that principal and interest payments are immediately reinvested and therefore the interest rate is compounded and payable in arrears. SocietyOne’s EAR calculation reflects only actual cash payments received and does not incorporate future looking projections of performance. As EAR is traditionally used to compare the annual interest rates between investments with different compounding terms during the year, SocietyOne believes it can provide loan investors with a more accurate way of calculating total investment returns as opposed to considering only the stated interest rate on a loan.

How is the EAR calculated?

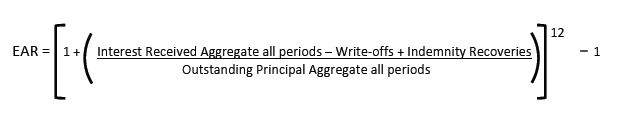

EAR is the output of a formula where the numerator is composed of interest received net of any write-offs. If a loan does not get paid, the interest received for that period will be zero. If a loan is "written-off", the entire principal amount of the loan is subtracted from the numerator. Thus, in the numerator, we accumulate all interest received minus any write-offs for all relevant periods. Next, we divide this result by the denominator, which is the accumulation of the outstanding principal amount of the loan for all relevant periods. This yields a fraction for the period. The final step in the calculation involves annualising the result. We take 1 + the dollar-weighted average performance for all periods, raise it to the 12th power to reflect the number of compounding periods for the year, and subtract 1. This result is the Effective Annualised Return, expressed as a percentage. See formula below:

Formula Rules

The following are rules and examples when calculating the EAR:

Determining when loans can be included in the formula

To be included in the EAR calculation, a loan must have been issued more than three (3) months prior to the calculation date.

Determining which periods are included in the formula

If it’s been more than 3 months since loan purchase, an EAR can be calculated and displayed on an Investor’s summary page. After that, the EAR calculation is perpetual (until termination of the loan): meaning, loans don’t drop out after 12 months of history. This is why the formula is annualised and results in a fair assessment of determining an investor’s loan performance.

Limitations of EAR

EAR is just one method to calculate the return on cash invested in the SocietyOne P2P Lending Trust. We think it is the most useful and accurate way to measure investment performance and compare effective returns because it takes into account actual cash received and write-offs. However, there are other methods for evaluating historical investment returns on fixed-income securities that you could consider.

Hide Info